Literature Review

The code of corporate governance

Over the years, Nigeria has experienced rapid development with regards to corporate governance. This can be noted in the 2003 Code of Corporate Governance (SEC Code), the 2006 mandatory Code of Corporate Governance for Nigerian Banks post consolidation (CBN Code) and most importantly the 2007 Code of Conduct for Shareholder Associations in Nigeria (SEC Code for shareholders). {(now revised in 2011) update the dates for the different codes}. According to Grienenberger (1995), corporate governance can be defined as

“The legal and practical system for the exercise of power and control in the conduct of the business of a corporation, including in particular the relationships amongst the shareholders, the management, the board of the directors and its committees, and other constituencies.”

The main issue with corporate governance is that it is often viewed as the separation between ownership (shareholders) and control (managers). Jensen and Meckling (1976) state that managers will only be as incentivized to add value to shareholders in proportion to what they stand to personally gain. Schacht (1995) then argues that corporate governance represents the friction that managers and owners of public companies face in the involvement of the productive level of shareholders in corporate policy and administration.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Nigeria was a British colony therefore it adopted the corporate governance system of the British and it’s history of corporate governance stems from the colonial times when the private sector was dominated by British companies (Okike 2007, Ahunwan 2002). After she gained her independence in 1960, there was a great economic liberation and the government developed domestic ownership and control of the Nigerian private sector (Akpotaire 2005). The framework of corporate governance adopted was still that of the British. For instance, there was the replacement of the Companies Ordinance of 1992 by the 1968 (how can the ’68 replace the ’92) Companies Act but the biggest influence was the UK corporate law (Adegbite and Nakajima, 2010). It is not unimaginable that since the corporate governance of Nigeria mirrors that of the British so closely, the effectiveness would be somewhat guaranteed. Unfortunately this has not been the case. It could be easily explained by the fact that the corporate laws and regulations in the UK are not complementary, reflective or applicable in the Nigerian business environment (Adegbite and Nakajima, 2010). Okike (2007) states that though the framework of the corporate governance in Nigeria mirrors that of the UK, the same cannot be said in terms of application or ingrained principles. Ultimately, it seems the legal or corporate governance codes governing corporations have not been developed with the peculiarities of Nigeria in mind. The issues that are specific to the cultural and political environments have also been ignored (Okike, 2007) and these are of utmost importance especially when considering the unstructured and informal nature of the Nigerian economy (Yahaya, 1998). In the years that follow, I believe this error was trying to be corrected by making codes to reflect Nigeria as a country and her corporate environment. According to Adegbite et. al (2012)

“The primary statute empowering shareholders in Nigeria to intervene in a company’s affairs is the Company and Allied Matters Act (CAMA) 1990 (as amended).”

In addition to this as stated above was the 2003 Code of Corporate Governance (SEC Code). Adegbite et. al (2012) goes on to state that this code has as one of its core focuses to promote the rights and responsibilities of shareholders. It expressly states that the company or board should not discourage shareholder activism whether institutional or by organised shareholders’ groups. It further states that the annual general meetings (AGMs) should be an avenue for shareholder participation in the governance of the company. Furthermore, there should be a director who represents the interests of minority shareholders who occupies a seat on the board. Okike (2007) believes that these are all efforts of the Corporate Affairs Commission (CAC) and the Securities and Exchange Commission (SEC) to promote shareholder activism as well as the rights of minority shareholders in the Nigerian corporate governance code.

As a result of all these developments, there have now been an emergence of many private initiatives which have been encouraged by the government such as The Independent Shareholders’ Association of Nigeria (ISAN), the Nigerian Shareholders’ Solidarity Association (NSSA), the Proactive Shareholders’ Association of Nigeria (PROSAN), the Association for the Advancement of the Rights of Nigerian Shareholders (AARNS) amongst other shareholder associations. These have developed mainly to give minority shareholders a chance in a sector that has been dominated by majority shareholders when it comes to block voting.

The issue of Politics and its impact on Shareholder Activism

In a recent study, Adegbite et. al (2012) state that an environment of unhealthy and vast politicking is created when shareholder activism is used as corporate governance mechanism in Nigeria. It is believed that this is as a result of the country’s brand of politics, in other words expressing that this is a challenge that is quite peculiar to Nigeria. It denotes that though shareholder activism is somewhat a universal practice, certain characteristics of different regions warrant an understanding before said practice can be carried out correctly. Most literature on shareholder activism is based on the Anglo-Saxon construction of markets as prior to independence from the British, the Anglo Saxon-based system of corporate law and regulations was in place in Nigeria (Adegbite and Nakajima, 2010). This is founded on the neo-liberal conception of democratic politics where there is freedom and rights within legitimate institutional boundaries. Also, under the same umbrella of this ideology is shareholder activism, as it is an essential characteristic to the financial markets (Adegbite et. al 2012). This has led to little thought being given to the effect that the post-independence stage of political democracy has on the way in which different things are practiced and in particular, shareholder activism. Given these points, let’s look further into the democratic political state of Nigeria.

Nigeria gained her independence on October 1, 1960. In the 56 years of her independence, she has been vastly ridiculed with the plague of corruption. This has been evident in the politics of the nation, the way business is conducted – both local and international and the general way of life of her people. Unfortunately, we follow this through many years of various scandals such as Cadbury 2014 and infamously Shell 1990 to present. It would be almost obvious that this corruption tremendously affects the business environment and by extension, shareholder activism. This can be evidenced by looking at independent corruption indexes. In appendix 1, we see extracts from various reports from the Transparency International (2013) which is a non-governmental organisation. These reports show Nigeria ranking 136 out of 178 countries (178 being the most corrupt country) in the corruption index as well as having a score of 26 (100 being corrupt free). More importantly, in the index of corruption by political parties, Nigeria scored 4.7 out of 5 (5 being extremely corrupt).

This data is one that cannot be ignored in the analysis of the political environment of the country having a direct/indirect effect on shareholder activism. Adegbite et al. (2012) also compare the World Bank index which is based on six broad measures: (1) voice and accountability, (2) political stability, (3) government effectiveness, (4) regulatory quality, (5) rule of law and (6) control of corruption. Three countries are examined namely Nigeria, Denmark and the United Kingdom. The latter mentioned countries score very low on the corruption index in the Transparency International reports and so it’s no surprise that in the World Bank Anti-Corruption and Governance Index, the same results are observed with Nigeria scoring less than 28% in all 6 categories while Denmark and the United Kingdom score higher than 80% across the same categories. These results all highlight the same issue. It is the implications of the

“Corrupt and greed driven Nigerian politics and political culture on business conduct, corporate governance and shareholder activism in particular” (Adegbite et. al 2012).

In light of all of this, it would be unfair not to mention that there are steps taken to mitigate this issue of corruption especially in the attitude towards corporate governance. Only a few years ago, the Central Bank of Nigeria (CBN) dismissed the Chief Executive Officers and Executive Directors or eight Nigerian banks on charges of corruption, fraud and bad corporate governance (Adegbite and Nakajima, 2010). These steps are definitely in the right path to getting the country to where it needs to be but the fact still remains that this is a serious consideration when addressing corporate governance and shareholder activism in Nigeria. As this has been established, the different matters around shareholders’ associations and institutional shareholders have been discussed below.

Institutional shareholders and Non-institutional shareholders (shareholder associations)

The Nigerian Stock Exchange (NSE) has been in existence for about 46 years. It has over 260 listed securities including 10 Government Stock, 55 industrial loans (Debenture/Preferences) stocks and 195 equity/ordinary shares of companies with a total capitalisation of about 875.2 billion naira. Shareholding in Nigeria has grown rapidly to an estimated 10 million (Amao and Amaeshi, 2008). There have been a series of events such as the privatisation programme in Nigeria that has massively impacted the share ownership. In the early stages of the programme, the privatised companies offered over 1.3 billion shares for sale to the public. There was a huge influx of first time buyers as well others amounting to over 800,000 shareholders. Between 1989 and 2005, over forty government-owned companies were privatised (Tanko II, 2004).

Small individual shareholders coming together to form shareholders’ associations and large individual shareholders are categories of Non-institutional shareholders. (Crespi & Renneboog, 2010; Poulsen et al., 2010; Song & Szewczyk, 2003; Uche, C., Adegbite, E. and John Jones, M. 2016). The way in which shareholder activism is carried out and achieved by small and large individual shareholders is mainly attributable to their shareholdings (Connelly, Tihanyi, Certo & Hitt, 2010; Crespi & Renneboog, 2010; Johnson, Schnatterly, Johnson, & Chiu, 2010; Uche et al., 2016). Due to the amount of shareholdings that small individual shareholders possess, they are at a disadvantage in the matter of having influence over management. In order to combat this, small individual shareholders often combine voting rights with that of other shareholders thus increasing their influence when engaging in shareholder activism. By doing so, they bypass the need for large block holding. Coordination by small individual shareholders is then achieved by using organizations such as shareholders’ associations. While this teamwork doesn’t result in the influence of corporate strategy or board nominations, Strickland et al. (1996) states that it brings about certain advantages such as successful shareholder-initiated proposals documented in countries such as the United States of America.

Shareholder’s associations are a registered group mainly consisting of small individual shareholders while Institutional shareholders is a term for entities which pool money to purchase securities, real property, and other investment assets or originate loans. Institutional shareholders include banks, insurance companies, pensions, hedge funds, REITs, investment advisors, endowments, and mutual funds. In this section, the relationship between these two will be analyzed as well as the effects their union or otherwise has on shareholder activism. According to Uche, Adegbite and John Jones (2016), prior literature has shown how beneficial collaborations between shareholders’ associations and institutional shareholders’ have been in shareholder activism. Examples of this is institutional shareholders using their proxy votes to support shareholder proposals. However, there has been little work done in this area regarding a developing country as well as the effect that activism carried out by shareholders’ associations has on institutional shareholders (Uche, Adegbite and John Jones, 2016).

According to Mulgan (2000) and Uche et al., (2016)

“Accountability is considered to be an activity that requires the accountee to engage in questioning, assessing and criticizing when holding the accountor to account”.

It is believed to be a two way conversation between accountee and accountor. Uche et al., (2016) notes that the accountability relationship theory isn’t discussed in a corporate environment by Mulgan (2000) but similar characteristics have been identified in the relationship between the board members and management. These characteristics were identified by Roberts et al., (2005) as “questioning, probing, discussing, informing and encouraging”. In addition, it is evident that shareholder activism share these same features. This is because Institutional shareholders and shareholders’ associations involve in discussion, probing and questioning management at AGMs and other private meetings (Uche et al., 2016; Roberts et al., 2006; Solomon and Darby, 2005). These conversations with shareholders’ associations and institutional shareholders also allow companies to gain insight into different issues on social, ethical and environmental issues which in turn aids in promoting corporate matters aimed at the public (Solomon and Darby, 2005; Amao and Amaeshi, 2008; Johed and Catasus, 2015).

As mentioned in earlier sections, Nigeria is home to many shareholders’ associations. There are more than thirty organisations unlike other more developed countries such as the United Kingdom which usually has only one association engaging in shareholder activism (Amao & Amaeshi, 2008; Adegbite, Amaeshi & Amoa, 2012). Uche, Adegbite and John Jones (2016) importantly highlights the importance of the structure of shareholders’ associations in Nigeria. These associations are made up only of small individual shareholders. The reason this is important to note is because of the impact it has on strategies carried out by the organisations. It also indicates the amount of influence or lack thereof that these organisations may have on the management of companies and thus shareholder activism.

In shareholder activism, the expectation is that the shareholders are able to exert a certain level of influence over management of a company which will allow them to facilitate change in strategic outcome or managerial decisions (Ryan and Schneider, 2002). This influence is much easier when there is an independence between the activists and management of the company involved. This can be seen in the analysis between institutional shareholders, shareholders’ association and management within the boundary of shareholder activism (Uche et al., 2016; Becht et al., 2008; Catasus and Johed 2007; Crespi and Renneboog, 2010; Ingley and Van der Walt, 2001; Johed and Catasus 2015). The independence noted in relationships between shareholders’ associations and managements of companies allow for the association to have an increased influence over management (Uche et al., 2016; Poulsen et al., 2010)

A lack of independence is noted in easily pressured institutional shareholders. This causes these type of investors to rather guard the relationships formed with managements of the company involved for their own benefits .This type of behavior is usually noted in passive institutional shareholders than active institutional shareholders (Uche et al., 2016; Almazan, Hartzell and Starks, 2005; Brickley, Lease and Smith 1998; Marler and Faugere, 2010). Prior literature has shown that there is a difference in the way various institutional shareholders carry out shareholder activism. This allows them to benefit in different ways from the way others carry out their activist activities (Uche, Adegbite and John Jones, 2016). Active institutional shareholders will benefit from things such as coordinated voting with other institutional shareholders or shareholders’ associations while the same may not be the case for institutional shareholders that are passive. Passive institutional shareholders as the name suggests, have a more laissez-faire attitude towards shareholder activism. They prefer to avoid any direct activist activities while benefiting from that which active shareholder institutions and shareholders’ associations have fought for (Brav, Jiang, Partnoy, & Thomas, 2008). These passive institutional shareholders in Nigeria are usually hedge funds or pension funds who focus on short term benefits and don’t want to disrupt the business relationships built with these companies.

It is argued that shareholders’ associations don’t experience this same dynamic between them and management of any company in questions regarding shareholder activism (Uche et al., 2016; Stratling, 2012). However, according to Uche et al., 2016, Adegbite et al., 2010 and Yakasi, 2001, it has been reported that some shareholders’ associations in Nigeria develop relationships with management because of financial benefits obtained outside of the business relationship. This then leads to a lack of independence and hinders the shareholders’ associations from acting as accountees and holding the accountors (management of the company in question) to account.

Prior research notes that different shareholder groups have different agendas that they pursue and though these may be similar in multiple cases, they can also differ. This is as a result of their interests and time horizons being different (Uche et al., 2016; Goranova & Ryan, 2014; Ingley & Van der Walt, 2001). Individual shareholders usually invest smaller stakes over a short period of time while institutional shareholders such as pension funds will invest massively over a long period of time. Fundamental differences such as these cause conflicts between the groups in shareholder activism. For instance, hedge funds prefer short term pay puts thus are more short term oriented (Uche et al., 2016).

Ultimately, in Nigeria, institutional shareholders do not participate enough in shareholder activism especially in comparison to shareholders’ associations. As noted in earlier paragraphs, due to the small holdings of individual shareholders who make up shareholders’ association they are not able to practice shareholder activism as effectively as they should (Uche et al., 2016; Amao & Amaeshi, 2008; Okike, 2007; Yakasai, 2001). Despite this, it has been noted that shareholders’ associations have been of great help in holding management of companies accountable by resisting the fraudulent sale of corporate sales and sacking of poorly performing corporate executives through shareholder activism (Uche et al., 2016; Aderinokun, 2003; Chigbo, 2000). The Nigerian Securities and Exchange Commission (SEC) code (both 2003 and the revised code in 2011) avidly encourage institutional shareholders and organised shareholders groups to actively engage in shareholder activism so as to improve practices (SEC Code, 2003; SEC Code 2011). While institutional shareholders are not there to usurp the role of monitoring agencies, they are in a better position to pressurise companies to take shareholder accountability and interest more seriously (Chung & Talaulicar, 2010; Roberts et al., 2006). In the face of previous scandals and governance and accountability problems in Nigeria, institutional shareholders now have another opportunity to fight for improved governance practices so as to create better shareholder values (Ahunwan, 2002; Bakre, 2007; CBN, 2006). According to Yakasai (2011) and Ajogwu (2007), Institutional shareholders are in a better strategic position than small shareholders to engage with corporate managers. Their influence can bridge the gap of communication between shareholders and really have an impact on corporate governance practices. All of this highlights the importance of both institutional shareholders and shareholders associations to practice shareholder activism (together and independently) independent of management of companies so as to relinquish all forms of bias in order to improve the effectiveness of shareholder activism in Nigeria.

RESEARCH METHODOLOGY

Introduction

This chapter illustrates the methodology used in this research to achieve my results. Research methodology is crucial to any research as it highlights the reasoning behind methods chosen to achieve the aims and objectives of this research (Kothari, 2004). The purpose of this paper is to clearly state what Shareholder Activism is and take a closer look into Sub-saharan Africa, more specifically Nigeria. It will also highlight three main areas that grossly affect the practice of shareholder activism in Nigeria as well as offer suggestions that could make the experience a much more efficient and effective one. To achieve this, this chapter has been divided into various sub sections namely, research philosophy, approach, strategy, time horizons, data collection and data analysis.

Research Philosophy

“Research philosophy is an over-arching term relating to the development of knowledge and the nature of that knowledge.” (Bandaranayake, 2012). According to Saunders, Lewis and Thornhill (2003), research philosophy is dominated by three main views namely Positivism, Interpretivism (Social Constructionism) and Realism.

Positivism as described by Saunders, Lewis and Thornhill (2003), is a view that often adopts the philosophical science of the natural scientist. This research perspective is one of utmost objectivity, completely independent from the researcher and unaffected by the research or its results.

Interpretivism/Social Constructionism views reality as based on human practices formed by human interactions with others and the world in which they live in, developed within a social context (Crotty, 1998). The intent of this approach is to understand the subjectivity of reality of the people being analyzed in order to deduce the background and reasoning of their motives in a way that’s applicable to them. (Ramanathan, 2008).

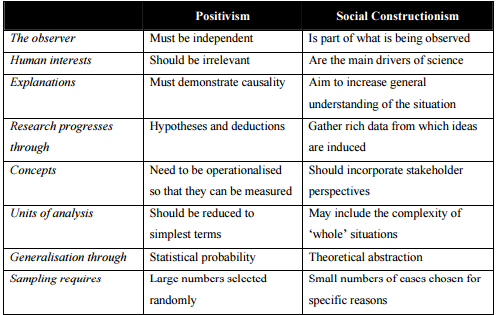

The key differences between Positivism and Interpretivism (Social Constructionism) are highlighted in the table below by (Ramanathan, 2008).

Saunders, Lewis and Thornhill (2003) state that

“Realism is applied to the study of human subjects, recognizing the importance of understanding people’s socially constructed interpretation and meaning, or subjective reality, within the context of seeking to understand broader social forces, structures or processes that influence, and perhaps constrain, the nature of people’s views and behaviours”.

According to Saunders, Lewis and Thornhill (2003), it will be misleading to think of any research philosophy as better than the next. Ultimately, all three philosophies serve different purposes depending on the objective of the research. Nonetheless, business situations such as shareholder activism are complex and unique to different individual’s circumstances and environment. Shareholder activism in Nigeria cannot be discussed without addressing the corporate governance environment of the country. According to Grienenberger (1995),

“Corporate governance can be defined as the legal and practical system for the exercise of power and control in the conduct of the businessof a corporation, including in particular the relationships amongst the shareholders, the management, the board of the directors and its committees, and other constituencies.”

This definition highlights two things that are very important. This is the fact that this is a legal and practical system. Every country has it’s own legal system that may derive its origin from many things such as the country which it was colonized by to the general way of life of the people. This in fact is the same for how business is conducted as well. Therefore, it is without doubt that an understanding of the country’s systems and the way in which things are done is essential for any well informed analysis to be made. This has therefore led me to choose interpretivism/social constructionism as my research philosophy as I believe that the characteristics of this philosophy such as aiming to increase the general understanding of the situation, gathering rich information from which ideas are induced and including stakeholder perspectives are all exactly the approaches I need to undertake in order to appropriately understand all the drivers involved in shaping shareholder activism in a developing country such as Nigeria.

Research Approach

When considering what research approach to use in research, there are two theories available. These are: Deduction (Testing theory) and Induction (Building theory).

Deduction approach as the name implies involves the researcher having a proposed theory (usually involving two or more variables) which they then collect data against, analyse and draw conclusions in support of or opposing the original thesis (DeGracia et al., 2014).

Induction approach on the other hand involves observing different cases or scenarios and then developing a general hypothesis around one’s findings (DeGracia et al., 2014). This approach allows for a less rigid methodology and openness to varying explanations of what is going on (Saunders, Lewis and Thornhill, 2003).

The table below shows the differences between Deduction and Induction approaches to Research by (Saunders, Lewis and Thornhill, 2003).

|

Box 4.1 |

Major differences between deductive and inductive approaches to research |

|

Deduction emphasises

Induction emphasises

|

|

The induction approach will be taken as this research looks into human behaviours and social construct within a certain environment. Furthermore, I will be making use of qualitative data alone to suit the approach adopted by Saunders, Lewis and Thornhill, (2003). This is because my research is looking into the problems associated with the lack of effectiveness of shareholder activism in Nigeria. This means that I am looking into the issues surrounding application, human behavior towards corporate governance and shareholder activism. Therefore, the induction approach as well as the use of qualitative data is the best way to get the different stakeholder perspectives and gather the right information within a less rigid structure that will enable the appropriate analysis to be conducted.

4.4 Research Strategy

According to Saunders, Lewis and Thornhill, (2003), there are different research strategies namely:

- Experiment

- Survey

- Case study

- Grounded theory

- Ethnography

- Action research

- Cross-sectional and longitudinal studies

- Exploratory, descriptive and explanatory studies.

For the purpose of this research, grounded theory will be used. This is because it is mainly used in the inductive approach and will allow for a more thorough insight into the issues associated with the objectives set in this research by using interviews (Corbin and Strauss, 1990). My source of data will be interviews and archival records as it allows me to capture insights into events associated with shareholder activism through the personal accounts of individual’s experiences (Hendry et all., 2007; Useem et al., 1993). As this research paper is focused on Nigeria, I have limited access to data as I am currently in the United Kingdom. Therefore, I have conducted telephone interviews with seasoned individuals practicing shareholder activism because it was more cost and time efficient to do so. I believe using these will give me a well-rounded view of the issues that need to be identified.

Time Horizons

There are two types of time horizons focused on by Saunders, Lewis and Thornhill, (2003) namely Cross-sectional studies and longitudinal studies. Cross- sectional studies have to do with research on a particular hypothesis at a particular time, while longitudinal studies involve researching a certain phenomenon over an extended period of time. This research focuses on Shareholder Activism in Nigeria, over the years there has been very little written on this subject matter. My aim is to add to the body of knowledge which exists in current times. In this case, I will be applying cross-sectional studies and focusing on the periods from the early 2010 to present day 2016.

Data Collection

The main research method in this paper will be the interviews conducted with persons that are knowledgeable on the subject. As I am not very conversant with the subject matter, speaking with these people will aid in expanding my knowledge. It is quite expensive to travel to Nigeria from the United Kingdom therefore, telephone interviews will be conducted as it will save time and costs. I also plan on using archival records as I believe this will provide context to my research thus allowing me to form a well-rounded grounded theory.

Data Analysis

Various solid articles and books will be used to aid in my coding and analysis of the intervi

Cite This Work

To export a reference to this article please select a referencing style below:

Give Yourself The Academic Edge Today

- On-time delivery or your money back

- A fully qualified writer in your subject

- In-depth proofreading by our Quality Control Team

- 100% confidentiality, the work is never re-sold or published

- Standard 7-day amendment period

- A paper written to the standard ordered

- A detailed plagiarism report

- A comprehensive quality report

Essay Writing Service

Essay Writing

Service

AED558.00

Approximate costs for Undergraduate 2:2

1000 words

7 day delivery

Order An Essay TodayDelivered on-time or your money back

1858 reviews